- Nhận đường liên kết

- X

- Ứng dụng khác

- Nhận đường liên kết

- X

- Ứng dụng khác

Crypto exchange-traded fund (ETF) outflows continue on Friday, October 31, with BlackRock alone dumping 2,724 Bitcoin (BTC), worth over $292 million, over the past 24 hours.

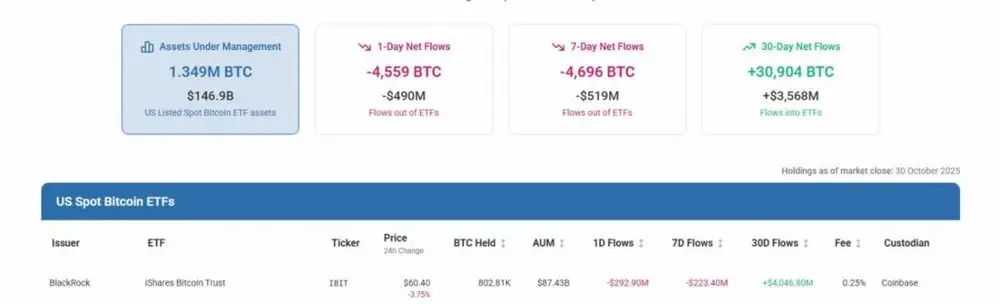

As of the time of writing, the world’s largest fund manager holds 802,810 BTC, valued at around $87.43 billion, according to the data Finbold retrieved from HeyApollo.

Overall, Bitcoin ETFs have lost roughly $519 million in assets under management this week, now commanding 1.349 million BTC, or $146.9 billion in the digital asset.

Interestingly, the outflows came amid a $500 million private-credit fraud scandal tied to BlackRock’s recently acquired HPS division.

Court filings allege forged contracts and fake invoices used to secure loans, raising questions over investment standards just months after BlackRock sealed the $12 billion buyout.

Daily Bitcoin ETF flows

Bitcoin ETFs faced a combined daily loss of 4,559 BTC ($490 million). BlackRock recorded the biggest numbers. Ark followed with $65.62 million withdrawn, while Bitwise’s saw a $55.15 million exit.

Fidelity was slightly behind, losing only $46.5 million, while Grayscale Bitcoin Trust shed only $10 million.

Other smaller outflows included Grayscale Mini Trust at $8.49 million, Invesco likewise at $8 million, and VanEck at $3.8 million.

Despite the heavy losses, the monthly chart is still in the green, showing an increase of 30,904 BTC, worth north of $3.56 billion.

Even amid all the ETF pressure, Bitcoin edged higher on Friday, rising past the $110,000 mark again.

Trading volume, however, is down nearly 10%, sitting at $66.42 billion at press time, while the market cap is up a modest 0.02%, at $2.19 trillion.

Meanwhile, leveraged Bitcoin traders face a potential $3 billion short squeeze if BTC rises past $112,600, setting up a volatile market backdrop, according to data Finbold retrieved from CoinGlass.

Featured image via Shutterstock

asset management

bitcoin

blackrock

btc selling

crypto market

cryptocurrency

digital assets

investment strategy

- Nhận đường liên kết

- X

- Ứng dụng khác

Nhận xét

Đăng nhận xét